Turn research into repeatable edge.

Common roadblocks we remove

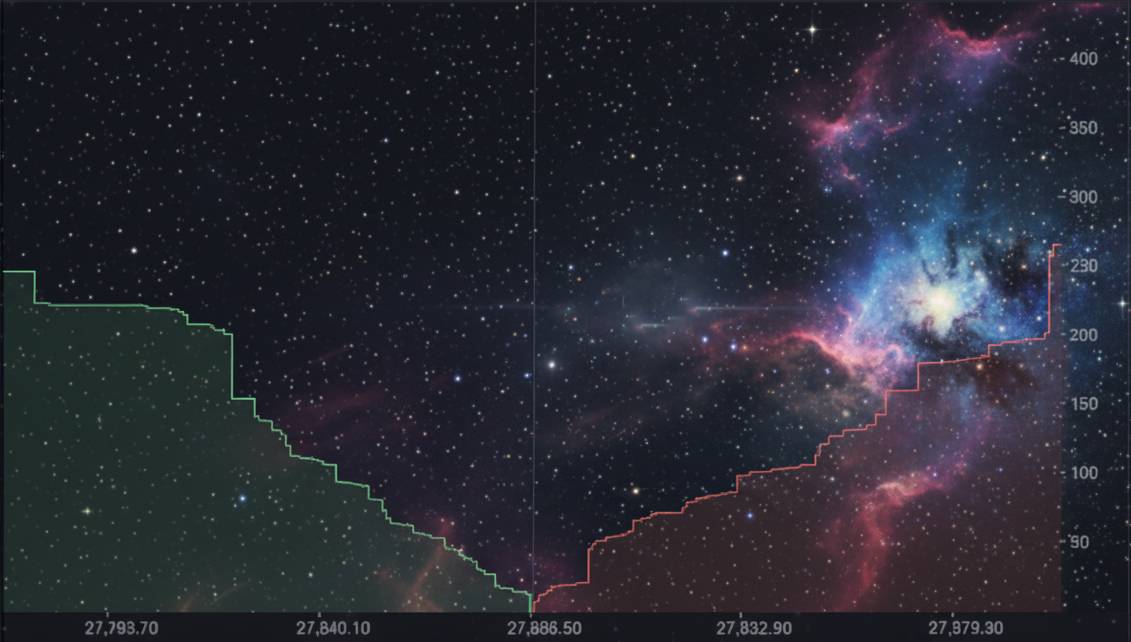

- Leaky datasets, look ahead bias, and survivorship issues

- Backtests that don’t match live behavior (fills, slippage, fees)

- Manual parameter tinkering with no out of sample discipline

- Untracked experiments and irreproducible results

- Strategy decay not caught by regime shifts or factor drift

Outcomes you can expect

- A reproducible research environment with versioned data + code

- Event driven backtesting that mirrors exchange/venue microstructure

- Walk forward, nested CV, and robust hyperparameter search

- Factor/feature libraries with diagnostics (alpha decay, turnover, crowding)

- Research governance: experiment tracking, reports, and audit trails

What We Build

Game-changing solutions

tailored to your unique needs

Artifacts You Keep:

- Versioned Datasets

- Feature Pipelines

- Backtest/Optimization Code

- Experiment Logs

- Reports

- Dashboards

Discovery & Research Audit

Review data lineage, simulation fidelity, and evaluation methods. Deliver a gap analysis and blueprint for controls and tooling.

Data & Feature Engineering

Build feature pipelines with leakage tests, versioned datasets, and reproducible research snapshots.

Backtesting & Optimization

Implement event accurate simulation, cost models, and optimization workflows (walk forward + HPO). Validate with paper trade.

Reporting & Handover

Research reports, dashboards, runbooks, and CI. Train your team; handover or shared operation.

Who We Serve

We build solutions for a wide range of teams, horizons, and asset classes.

Asset Classes

Equities

Futures

FX

Options

Digital Assets

Horizons

Intraday

Swing

Multi‑day

Teams

Hedge Funds

Family Offices

Proprietary Traders

Fintech Product Teams

Engagement Models

Our Technology Stack

We leverage a modern, robust technology stack to build high-performance, reliable, and scalable algorithmic trading solutions.

Security & Compliance

Access & controls

Role based access, network allow lists, segregated environments.

Confidentiality

Your datasets, features, and parameters remain private; public materials are sanitized.

Auditability

Versioned data, experiment tracking, and reproducible runs with seeds.