Solution

Approach: A cross-functional squad—Quant/Tech Lead, Execution Engineer, Data/Infra Engineer, QA/Ops Analyst—delivered iteratively on cloud infrastructure.

Architecture & runtime

Hardened cloud nodes with secure remote access and entitlement management; centralized configuration + relational DB to manage instruments, parameters, and audit logs.

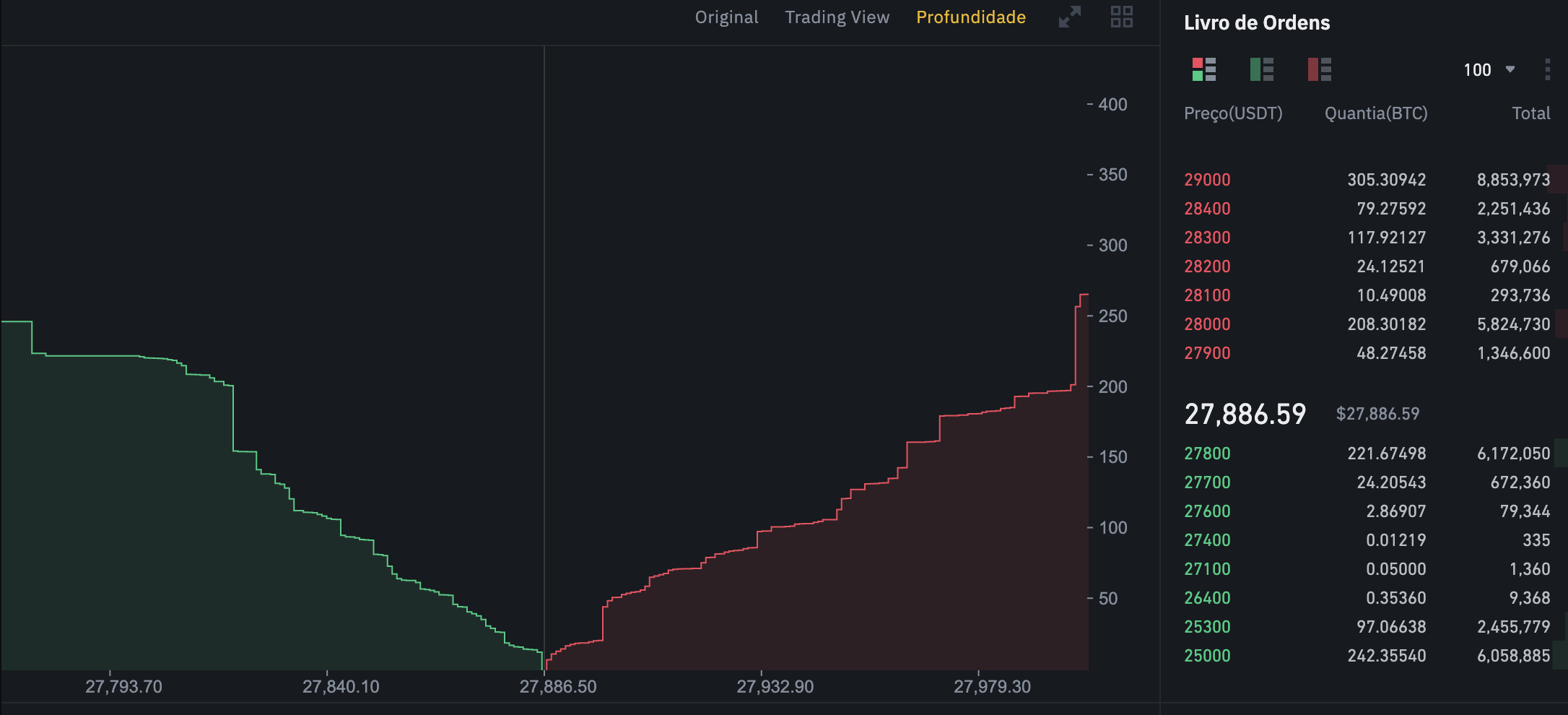

Order-book-adaptive execution

Built a depth-aware central price, standardized execution policy templates, and per-symbol depth acquisition modes to manage data constraints.

Cross-asset data hygiene

Integrated continuous futures series and dividend/corporate action updates into the runtime for consistent, cross-asset analytics.