Solution

Approach: A cross-functional Marsbridge squad—Quant Lead, Execution Engineer, Data/Infra Engineer, and QA/Ops Analyst—delivered the system in iterative drops: engine → GUI → integrations → scale-out → automation.

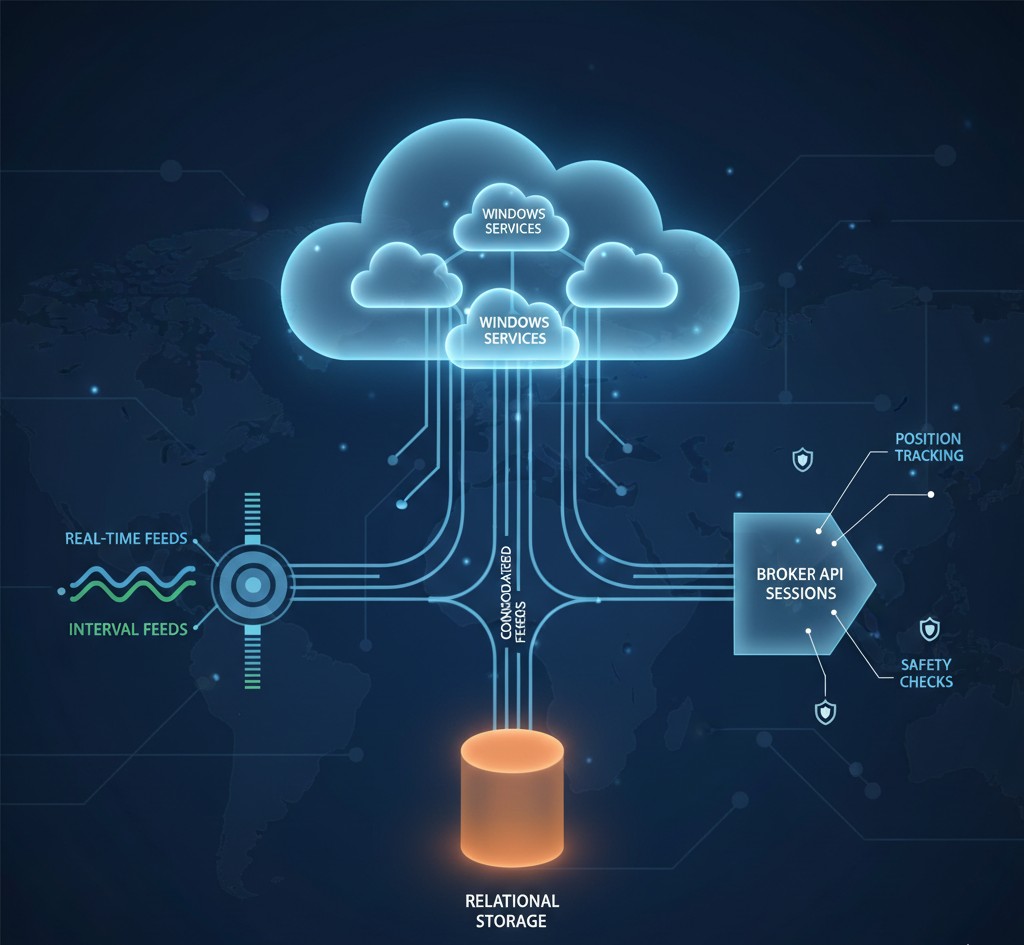

System architecture (cloud-hosted)

Multiple cloud nodes running Windows services; relational storage; consolidated real-time/interval feeds; and broker API sessions with position tracking and safety checks.

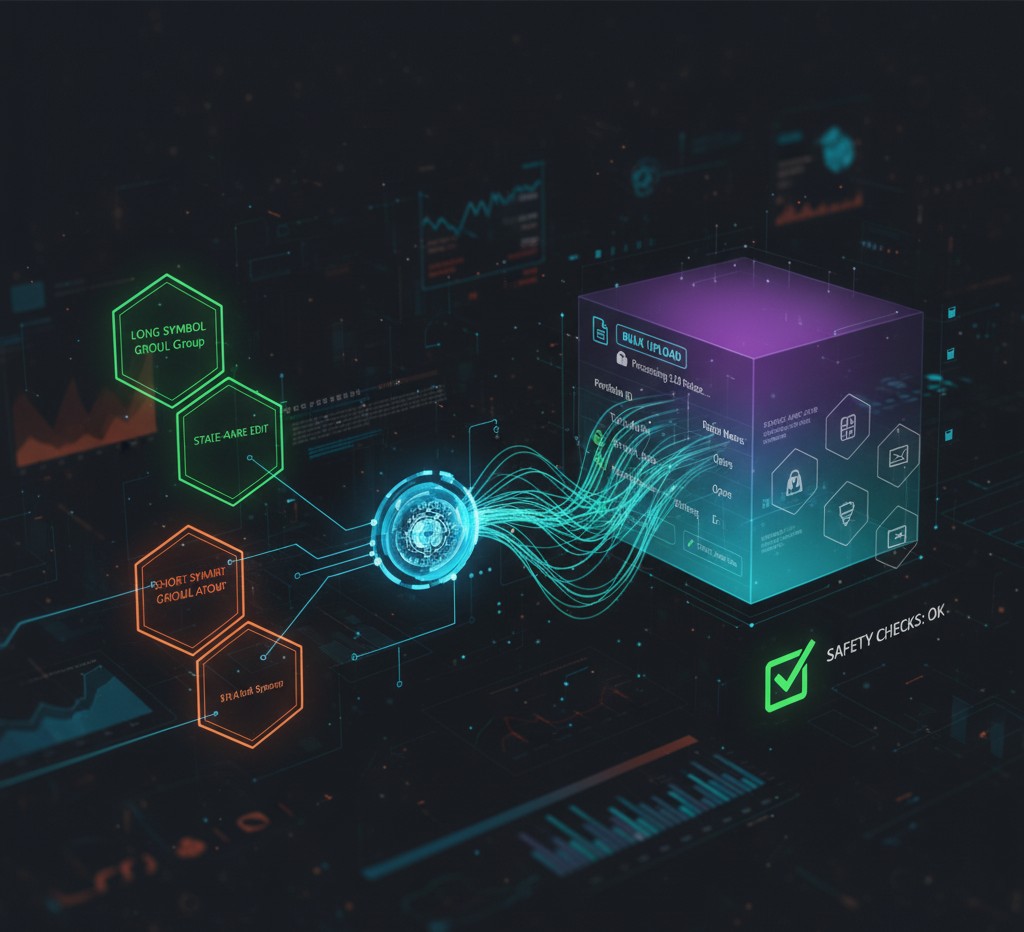

Synthetic ratio & portfolio controls

Ratios defined from long/short symbol groups with editable compositions. GUI supports bulk uploads and state-aware edits to preserve open state and reduce unintended trades.

Signal engines & performance

Generalized breakout-style and trend-following signal engines. System uses vectorization, batching, and a tuned latency budget for rapid compute and submission, with resilience checks and auto-restart.