Solution

Approach: A compact Risk & Research squad—Quant Lead, Data Engineer, and Research Analyst—delivered a clean test bed, generalized risk rules, and parameter-robust evaluation.

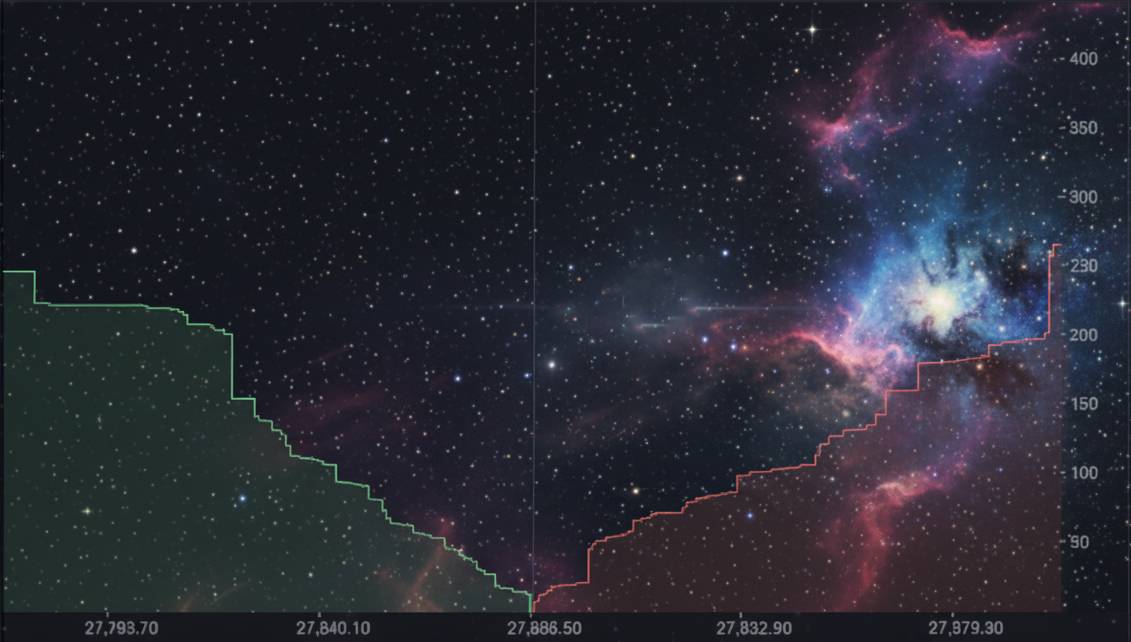

Bias diagnosis & corrected test bed

Recreated the strategy in code and isolated leakage pathways. Rebuilt the backtest on adjusted continuous series with open-interest/liquidity gating and clear timestamp causality.

Entry significance & exits (generalized)

Introduced entry-significance checks and designed stop/exit policies with configurable bands and trailing behavior; documented how to tune them.

Robustness & parameter risk

Ran grid/Monte-Carlo style sweeps across plausible ranges to observe envelopes of outcomes rather than single-point optima.