Solution

Comprehensive TCA and Execution Framework

Marsbridge assembled a quantitative execution-research team—Quant Lead, Execution Analyst, Data Engineer, Research Associate—to transform raw trade data into an analytics-ready pipeline, producing both diagnostics and tested redesigns.

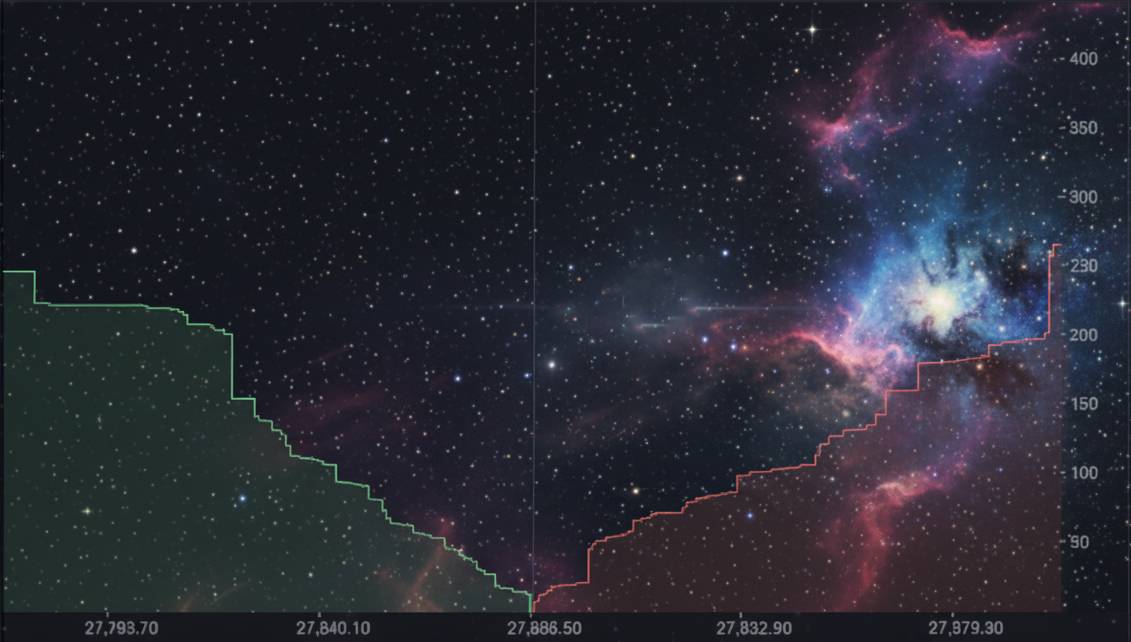

Data linkage & TCA analytics

Linked order, fill, and prediction data to create per-trade performance panels. Quantified execution costs (fees, slippage, market impact) under multiple routing and fee-tier assumptions. Built visual and tabular dashboards for cost attribution.

Execution redesign

Modeled routing and order-type alternatives to reduce cost and improve fill consistency. Designed guarded limit rules to avoid excessive price chasing. Created parametric timing controls for order submissions.

Portfolio structure optimization

Evaluated rebalancing frequency scenarios to minimize churn while maintaining signal exposure. Designed thresholding filters to skip marginal trades. Developed blended frameworks combining multiple holding periods.

Intraday trade-management logic

Implemented an intraday data engine for tracking realized performance vs. thresholds and tested profit-take/exit parameters through simulations.